Calendar Put Spread - The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with limited risk in either direction. If a trader is bearish, they would buy a calendar put spread. A calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. A put calendar spread is an options strategy that combines a short put and a long put with the same strike price, at different expirations. A long calendar spread is a good strategy to use when you expect the price to be near the strike price at the expiry of the. It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates.

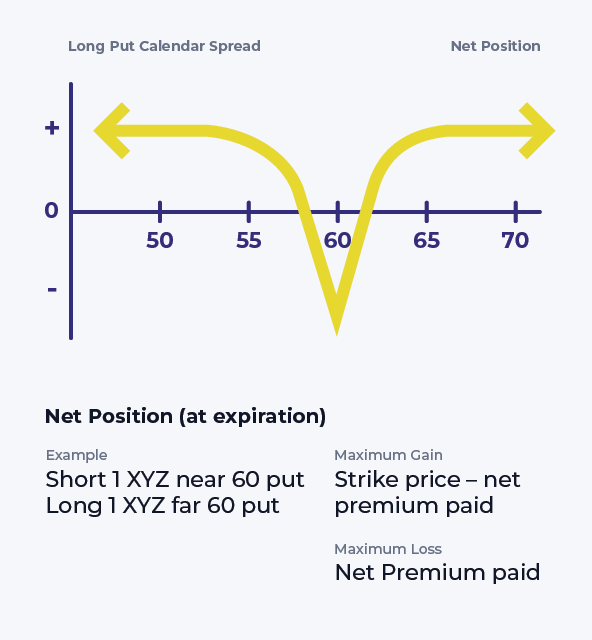

Long Put Calendar Spread (Put Horizontal) Options Strategy

If a trader is bearish, they would buy a calendar put spread. It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. A calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes.

Put Calendar Spread

A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month. It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. A calendar spread is an options or futures strategy.

Deep In The Money Put Calendar Spread Aubine Bobbette

A calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. A put calendar spread is an options strategy that combines a short put and a long put with the same strike price, at different expirations. It is sometimes referred to as a horiztonal.

Calendar Call Spread Strategy

A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month. The calendar spread options strategy is a.

Calendar Spread Put Sena Xylina

A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month. A long calendar spread is a good strategy to use when you expect the price to be near the strike price at the expiry of the. A put calendar spread is an options strategy that.

Long Calendar Spread with Puts Strategy With Example

The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with limited risk in either direction. It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month. The calendar spread options strategy is a.

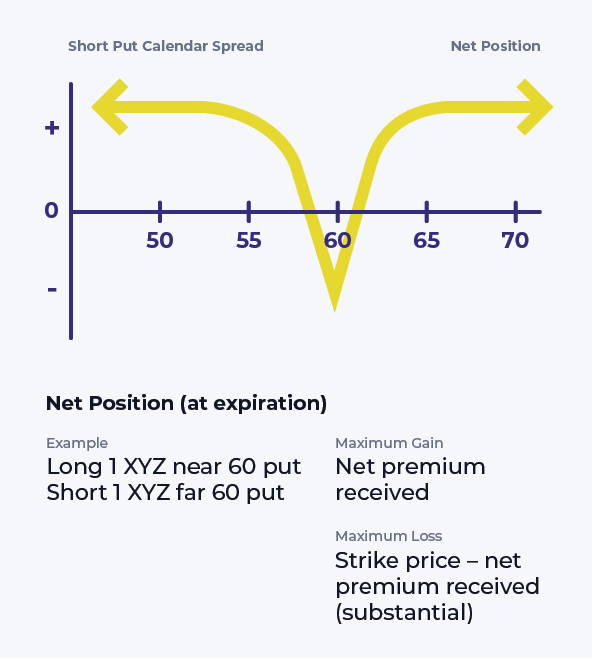

Short Put Calendar Spread Options Strategy

A calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. A put calendar spread is an options strategy that combines a short put and a long put with the same strike price, at different expirations. The calendar spread options strategy is a market.

It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with limited risk in either direction. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month. A long calendar spread is a good strategy to use when you expect the price to be near the strike price at the expiry of the. If a trader is bearish, they would buy a calendar put spread. A put calendar spread is an options strategy that combines a short put and a long put with the same strike price, at different expirations. A calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates.

A Long Calendar Put Spread Is Seasoned Option Strategy Where You Sell And Buy Same Strike Price Puts With The Purchased Put Expiring One Month.

A long calendar spread is a good strategy to use when you expect the price to be near the strike price at the expiry of the. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with limited risk in either direction. It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. A calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods.

A Put Calendar Spread Is An Options Strategy That Combines A Short Put And A Long Put With The Same Strike Price, At Different Expirations.

If a trader is bearish, they would buy a calendar put spread. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)