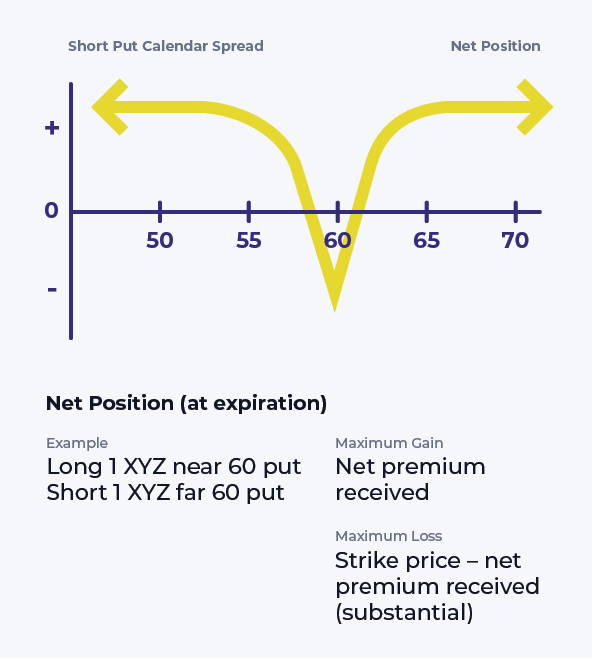

Short Put Calendar Spread - The strategy most commonly involves puts with the same. Selling an option contract you don’t yet own creates a “short” position. A long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different. You sell a put with a further out expiration and buy a put with a closer expiration date. A short put calendar spread is another type of spread that uses two different put options. The typical calendar spread trade involves the sale of an option (either a call or put). With a short put calendar spread, the two options have the same strike price but different expiration dates. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. A short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on the.

Short Put Calendar Spread

Selling an option contract you don’t yet own creates a “short” position. A long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different. You sell a put with a further out expiration and buy a put.

Short Put Calendar Spread Option Samurai Blog

Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. A short put calendar spread is another type of spread that uses two different put options. A long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the.

Advanced options strategies (Level 3) Robinhood

Selling an option contract you don’t yet own creates a “short” position. With a short put calendar spread, the two options have the same strike price but different expiration dates. The strategy most commonly involves puts with the same. A short put calendar spread is another type of spread that uses two different put options. Buying one put option and.

Short Put Calendar Spread Option Samurai Blog

Selling an option contract you don’t yet own creates a “short” position. A short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on the. Buying one put option and selling a second put option with a more distant expiration is an example of a short put.

Short Put Calendar Short put calendar Spread Reverse Calendar

The typical calendar spread trade involves the sale of an option (either a call or put). Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. With a short put calendar spread, the two options have the same strike price but different expiration dates. A short.

How to Create a Credit Spread with the Short Calendar Put Spread YouTube

With a short put calendar spread, the two options have the same strike price but different expiration dates. The typical calendar spread trade involves the sale of an option (either a call or put). Selling an option contract you don’t yet own creates a “short” position. A long calendar spread—often referred to as a time spread—is the buying and selling.

Short Put Calendar Spread Options Strategy

You sell a put with a further out expiration and buy a put with a closer expiration date. A short put calendar spread is another type of spread that uses two different put options. The typical calendar spread trade involves the sale of an option (either a call or put). A long calendar spread—often referred to as a time spread—is.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

A long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different. You sell a put with a further out expiration and buy a put with a closer expiration date. Buying one put option and selling a.

A short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on the. The strategy most commonly involves puts with the same. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. With a short put calendar spread, the two options have the same strike price but different expiration dates. A long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different. The typical calendar spread trade involves the sale of an option (either a call or put). Selling an option contract you don’t yet own creates a “short” position. A short put calendar spread is another type of spread that uses two different put options. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. You sell a put with a further out expiration and buy a put with a closer expiration date.

You Sell A Put With A Further Out Expiration And Buy A Put With A Closer Expiration Date.

Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. A long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different. A short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on the. Selling an option contract you don’t yet own creates a “short” position.

Buying One Put Option And Selling A Second Put Option With A More Distant Expiration Is An Example Of A Short Put Calendar Spread.

The strategy most commonly involves puts with the same. The typical calendar spread trade involves the sale of an option (either a call or put). With a short put calendar spread, the two options have the same strike price but different expiration dates. A short put calendar spread is another type of spread that uses two different put options.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)